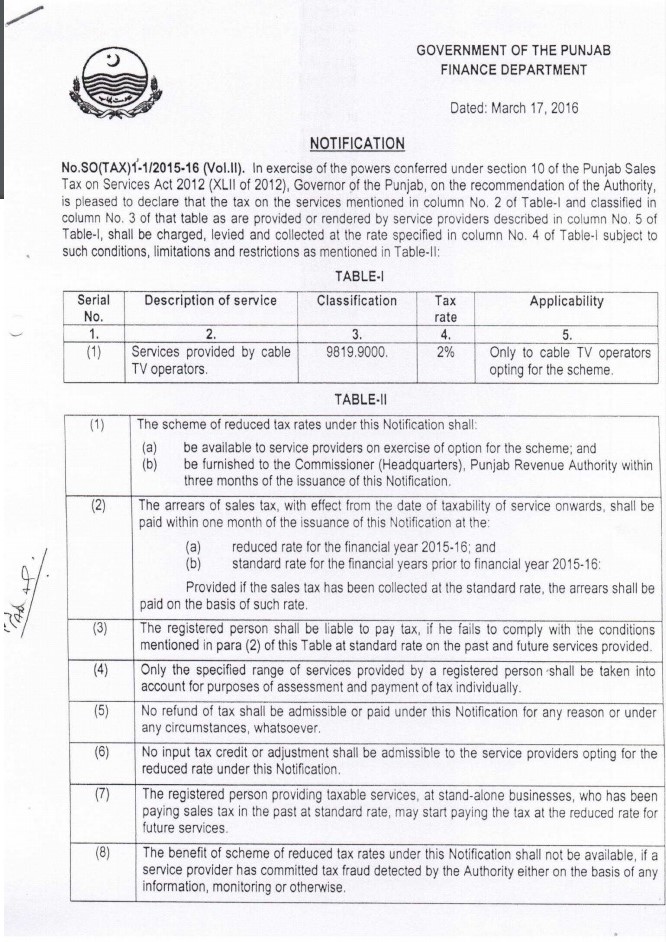

Reduced Rate for Cable Operators

Vide SRO NO. SO(TAX)1-1/2015-16 (Vol. II) dated 17.03.2016 Provincial Government has notified that the services provided by Cable TV Operators falling under heading 9819.9000 will be chargeable to 2% reduced rate of sales tax. This scheme is optional for the service providers subject to certain conditions which interalia includes (i) intimation to Commissioner (HQ) within three months of issuance of the notification to avail benefit of this notification (ii) payment of sales tax on their services at reduced rate for the tax year 2015-2016 and on standard rate for period prior to tax year 2015-16, (iii) inadmissibility of input tax, (iv) bar on claim of refund for the tax already paid; This notification has been initially issued for the tax year 2015-2016.