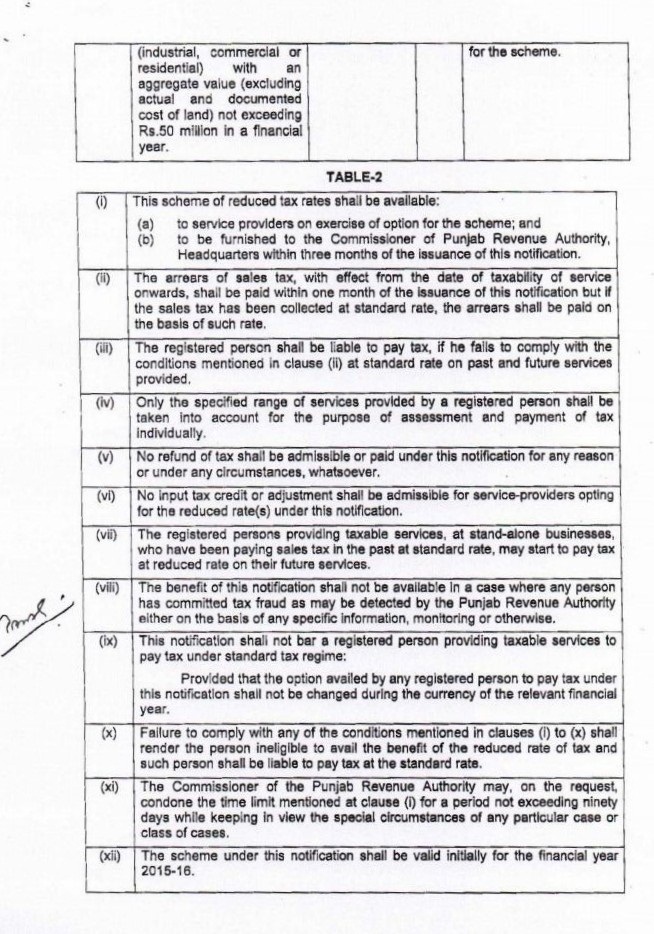

Reduced rate of Sales Tax on Services in Punjab

Vide SRO NO. SO(TAX)1-1/2015-16 (Vol. II) dated 11.01.2016 Provincial Government has notified that the following services provided by stand alone service providers of the specified services will be chargeable to reduced rate of sales tax. This scheme is optional for the specified service providers subject to certain conditions which interalia includes (i) intimation to Commissioner (HQ) within three months of issuance of the notification to avail benefit of this notification (ii) payment of sales tax on their services at reduced rate from the date of levy of sales tax on such services, (iii) inadmissibility of input tax, (iv) bar on claim of refund for the tax already paid; This notification has been initially issued for the tax year 2015-2016.

| Sr. No. | Description of service | Classification | Rate of Sales Tax |

| 1 | Services provided by laundries and dry cleaners |

9811.0000

|

5% |

| 2 | Services provided by non-authorized car automobile dealers |

9805.3000

|

5% |

| 3 | Services provided by non-authorized auto-workshops and by workshops of electric or electronic equipments and appliances (for domestic use only) |

9820.1000 and 9820.3000

|

5% |

| 4 | Services provided in specified fields such as health care, gyms and physical fitness |

9821.1000

|

5% |

| 5 | Services provided by hair-cutting, hair dyeing and shaving salons located outside the premises of a hotel, motel, guest house, club, air-conditioned beauty centre / parlour and air-conditioned shopping mall / plaza |

9810.0000 and respective heading

|

5% |

| 6 | Services provided by property dealers |

9806.2000

|

5% |

| 7 | Construction Services by such service providers whose annual turnover is below 50 million rupees |

9824.000

|

5% |