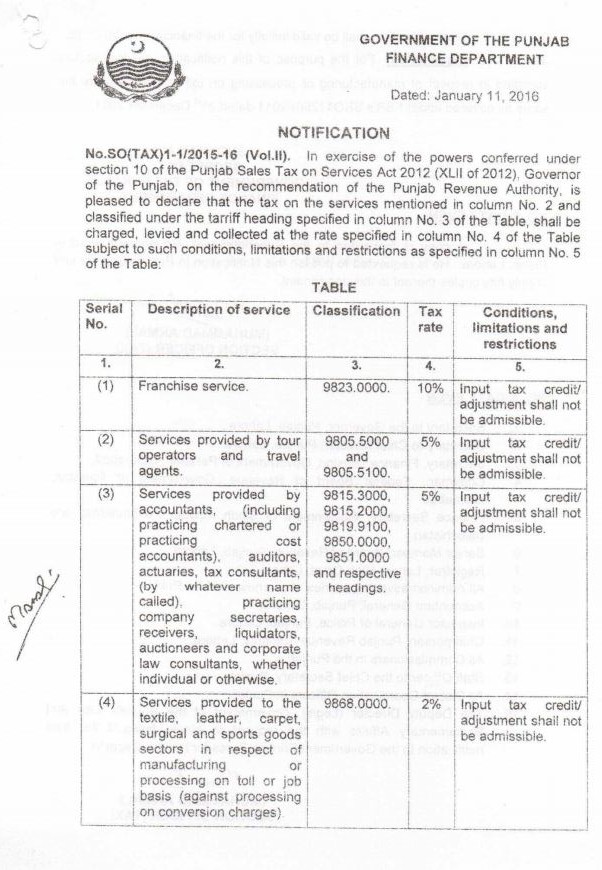

Reduced rate of Sales Tax on Services in Punjab

Vide SRO NO. SO(TAX)1-1/2015-16 (Vol. II) dated 11.01.2016 Provincial Government has notified that the following services will be chargeable to reduced rate of sales tax as specified against each. Simultaneously, input tax adjustment on these services has been disallowed. This notification has been initially issued for the tax year 2015-2016.

| Sr. No. | Description of service | Classification | Rate of Sales Tax |

| 1 | Franchise Services | 9823.0000 | 10% |

| 2 | Services provided by travel agents and tour operators |

9805.5000 |

5% |

| 3 | Services provided by accountants including Chartered Accountants, Cost Accountants, auditors, actuaries, tax consultants, practicing company secretaries, receivers, liquidators, auctioneers and corporate law consultants |

9815.3000

|

5% |

| 4 | Services of toll processing provided to the textile, leather, carpet, surgical and sports goods sector (sectors specified in Federal Government SRO 1125(I)/2011 dated 31.12.2011 | 9868.000 | 2% |